eCOOPNEWS Volume 8 Number 4

2/13/2015

Commodity Comment

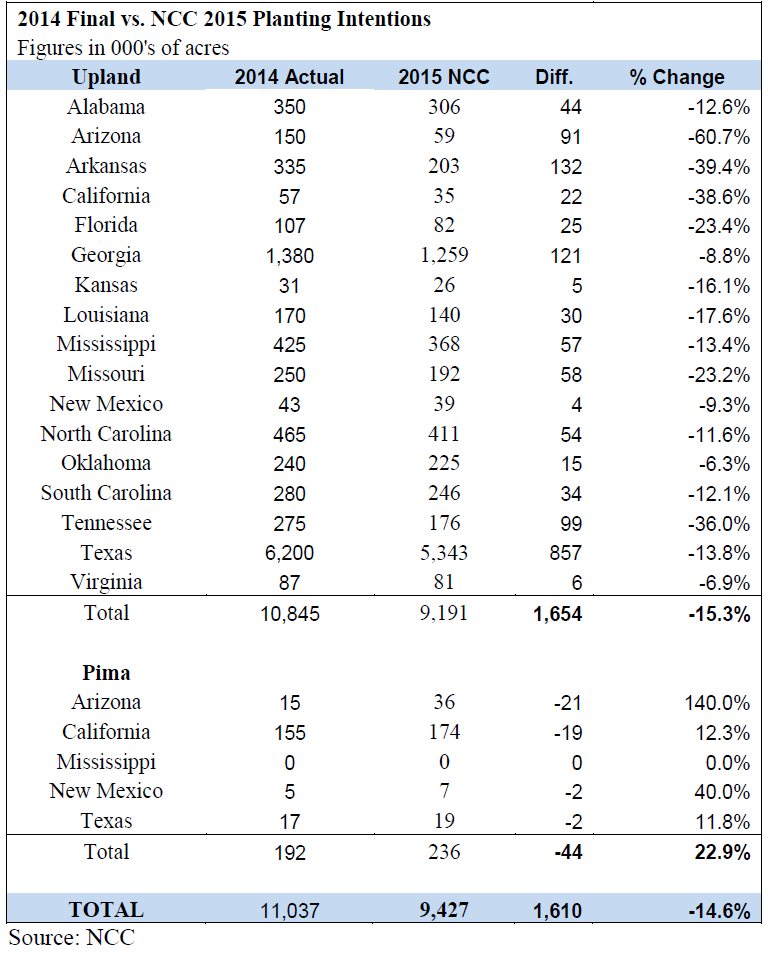

Monday’s supply demand report offered a little bit for the both the bulls and the bears. On the bullish side the recent strong export sales of the past month caused USDA to raise US exports by 700k bales and US ending stocks were lowered by 500k bales. This now leaves US ending stocks projected at 4.2 mln bales for this year. On the bearish side consumption was cut in China by 1 mln bales and the world crop was raised by 200k bales and in turn leaving world ending stocks at 109.8 mln bales. As expected the market traded two sided after the report but did manage to finish the day and the week firmer. Good demand for high quality US cotton is still supporting the market along with liquidation of spec longs. For the week Mar cotton closed at 62.70 up 111 pts. Last Saturday the National Cotton Council released their acreage survey for 2015 (see chart below). US acreage is expected to be down 15% overall with the biggest cuts coming from out West and the mid south. The Carolinas and Virginia are expected to be down around 11%. Dec cotton has been firmer all week after the report and closed today at 6407 up 52 pts for the week.

The supply demand report didn’t offer any exciting news for grains this week and for the most part this was a pretty uneventful week for corn, beans and wheat. Growers are still holding on to a lot of old crop corn and beans and end users seem content (for the time being) to wait them out and see if prices get cheaper. Exports are still pretty decent and many are watching developments in the South American bean crop to give direction in bean prices going forward. For the week Nov beans closed at $9.71 up 11 cents, Dec corn $4.17 unchanged and Jul wheat $5.32 up 1 cent.

Wayne Boseman

VP Brokerage